In the world of business and accounting, smooth transactions and proper record-keeping are essential. One of the key documents that help maintain transparency between buyers and sellers is the credit note. Whether you’re a small business owner, accountant, or a buyer, understanding credit notes can help you manage returns, discounts, and billing corrections efficiently.

About Vyapaarkhata: Vyapaarkhata is an easy-to-use online invoice app that helps businesses create professional invoices, track payments, and manage accounts quickly and securely. Simplify your billing process and stay organized—download Vyapaarkhata today!

What is a Credit Note?

A credit note is an official document issued by a seller to a buyer, acknowledging that a certain amount has been credited to the buyer’s account. It is usually issued in situations where:

- Goods are returned due to defects or damages.

- There was an overbilling or mistake in the original invoice.

- Discounts, allowances, or promotional credits are applicable.

Essentially, a credit note serves as proof that the seller owes money or credit to the buyer. It is an important document for accounting, taxation, and maintaining trust between business partners.

Key Features of a Credit Note

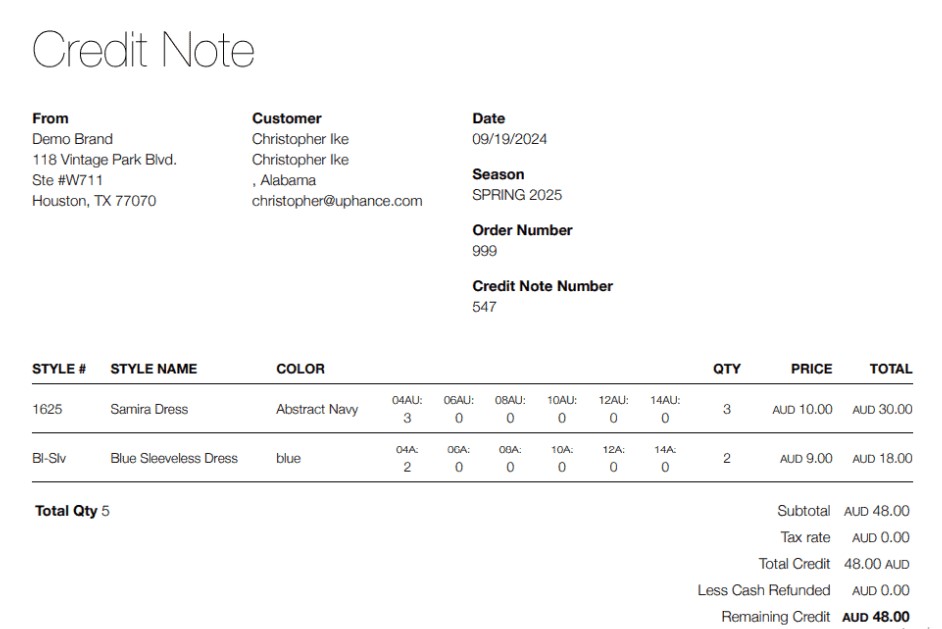

A credit note should include specific details to make it valid and effective. The essential elements include:

- Credit Note Number: A unique reference number for tracking.

- Date of Issue: The date when the credit note is generated.

- Buyer and Seller Details: Name, address, and contact information.

- Original Invoice Reference: The invoice number against which the credit is issued.

- Reason for Issuing: Explanation such as returned goods, billing error, or discount.

- Amount Credited: Total amount to be credited, including taxes if applicable.

- Terms and Conditions: Any clauses regarding future usage of the credit.

Including these details ensures transparency and prevents disputes.

Types of Credit Notes

Credit notes can be classified based on the purpose of issuance:

- Goods Return Credit Note: Issued when the buyer returns defective or unwanted goods.

- Billing Error Credit Note: Issued to correct an overcharge or mistake in the invoice.

- Discount or Allowance Credit Note: Issued to provide post-sale discounts, promotional credits, or allowances.

Each type has its specific accounting treatment and legal implications.

How a Credit Note Works

Here’s a step-by-step guide on how credit notes function in business:

- Initiation: The buyer requests a credit for returned goods or billing errors.

- Verification: The seller verifies the claim against the original invoice and purchase details.

- Issuance: A credit note is prepared and sent to the buyer, specifying the amount credited.

- Accounting Entry: The seller records the credit note in their accounts, reducing the receivable. The buyer records it as a reduction in payable or future credit.

- Future Transactions: The credited amount can be adjusted against future purchases or refunded as agreed.

Example: Suppose a buyer purchases goods worth Rs 50,000, but Rs 5,000 worth of items are defective and returned. The seller issues a credit note of Rs 5,000, which the buyer can use for future purchases or request a refund.Difference Between Credit Note and Debit Note

Understanding the difference is crucial for proper accounting:

| Credit Note | Debit Note |

|---|---|

| Issued by the seller to the buyer. | Issued by the buyer to the seller. |

| Represents money credited to the buyer’s account. | Represents money debited to the seller’s account. |

| Usually issued for returns, billing errors, or discounts. | Usually issued for underbilling, additional charges, or purchase discrepancies. |

Both documents ensure that accounting records remain accurate and transparent.

Importance of a Credit Note

Credit notes are not just formalities; they serve multiple purposes:

- Accurate Accounting: Helps maintain correct financial statements and avoids discrepancies.

- Legal Compliance: Credit notes are recognized for taxation and audit purposes.

- Customer Relationship: Shows professionalism and builds trust with buyers.

- Tax Adjustments: Helps in adjusting GST, VAT, or other taxes on returned goods or discounts.

Format of a Credit Note

A standard credit note typically includes:

- Header: “Credit Note” clearly mentioned.

- Unique Credit Note Number.

- Seller and Buyer Information.

- Date of Issue and Reference Invoice Number.

- Reason for Credit.

- Detailed Item List (if applicable) with quantities, price, and total amount.

- Tax details.

- Signature and seal of the authorized person.

Sample Layout:

CREDIT NOTE

Credit Note No: CN-101

Date: 05-Sep-2025

Seller: ABC Traders

Buyer: XYZ Enterprises

Original Invoice No: INV-2025-1001

Reason for Credit: Returned damaged goods

Description Quantity Rate Amount

Item A 10 500 5000

Item B 5 1000 5000

Total Amount Credited: Rs 10,000

Authorized Signatory

Common Mistakes to Avoid

While issuing a credit note, businesses should be cautious to avoid:

- Incorrect or missing credit note numbers.

- Not referencing the original invoice.

- Wrong amounts or tax calculations.

- Delayed issuance affecting accounts or tax filings.

- Missing reasons for issuance, leading to confusion or disputes.

A credit note is an essential document for smooth business operations. It ensures that financial transactions are transparent, accounting records are accurate, and legal obligations are met. Properly managing credit notes not only safeguards your business but also strengthens relationships with clients and suppliers.

Vyapaarkhata is a smart and user-friendly online invoice creation app designed to simplify billing for businesses of all sizes. With Vyapaarkhata, you can generate professional invoices, manage payments, track expenses, and maintain your accounts—all in one place. The app is fast, secure, and accessible from anywhere, making it ideal for small business owners, freelancers, and entrepreneurs who want to save time and stay organized. Streamline your invoicing process and enhance business efficiency—download Vyapaarkhata today and take control of your billing effortlessly!

Issuing credit notes promptly, accurately, and professionally can prevent misunderstandings, save time during audits, and improve overall business efficiency.

Optional Section: FAQs

- Can a credit note be issued after the payment is made?

Yes, a credit note can be issued even after the payment, and the buyer can adjust it in future purchases or request a refund. - Does a credit note affect GST?

Yes, in India, GST is adjusted according to the value mentioned in the credit note, reducing the output tax liability of the seller. - Is a credit note legally required?

While not mandatory in all cases, it is highly recommended for accurate accounting and tax compliance.